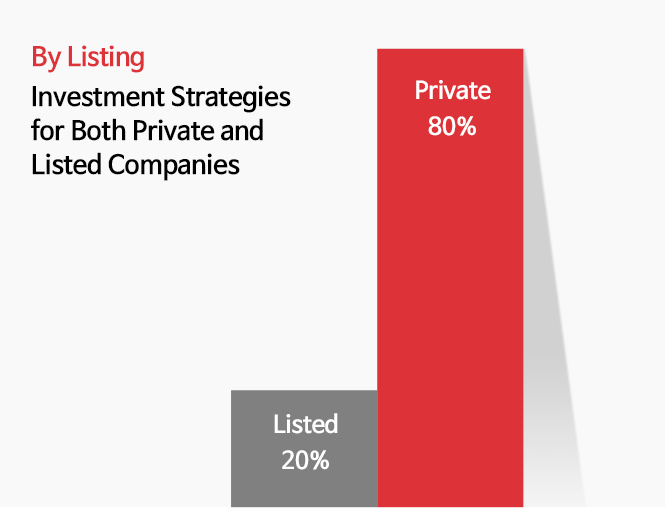

As a Venture Capital, DAYLI Partners invests in prospective private

bio-ventures home and abroad. Investment

decisions are made

based on the founder’s competence, management team, technology, and

valuation.

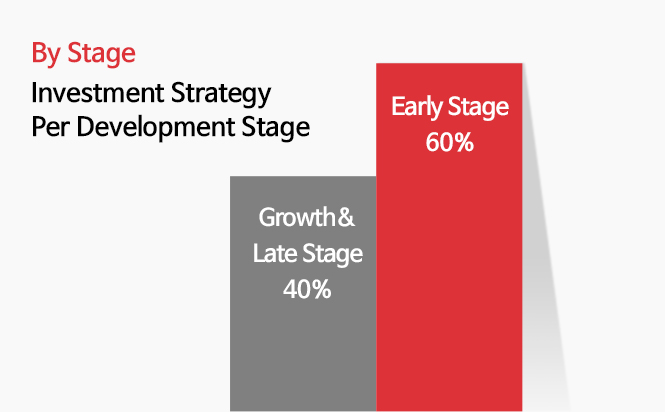

Investments are made across all stages of a

bio-venture’s life, ranging from Series A to pre-IPO. Moreover,

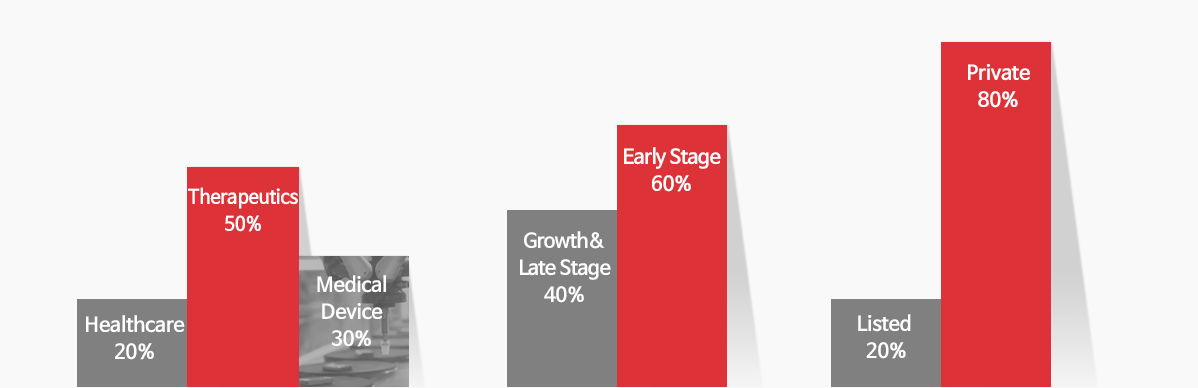

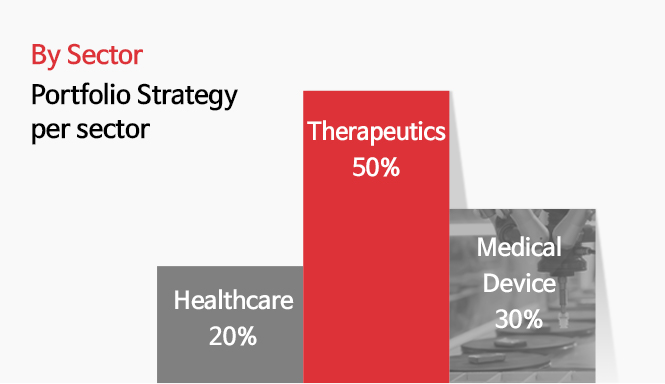

DAYLI Partners invests in all sectors within the bio-healthcare

industry, including therapeutics, life sciences, medical devices,

and diagnostics.

Deal sourcing of promising and competent startups with the perspective of capital markets

Valuation-Based Entry & Exit Judgments

Pre-emptive investments in competent

startups through

early deal sourcing

Value adding activities that maximize

the investee

company’s value

Top-down and bottom-up deal sourcing based on the understanding

of macro and micro environments

Portfolio Management Experience

Selection of competent companies that fit the global trend

Investments in First in Class and Best in Class R&D Companies

Investments in companies under-valued compared to peer groups

Follow On Investments

Higher

stability for rate of return

Higher

stability for rate of return